CHRISTINE LAGARDE MD OF THE IMF DESCRIBED THE RISE OF THE AFRICAN MARKET AS A “ONCE IN A GENERATION OPPORTUNITY”

via fintechcircle.com

Will Investors look farther than these 5 African Countries?

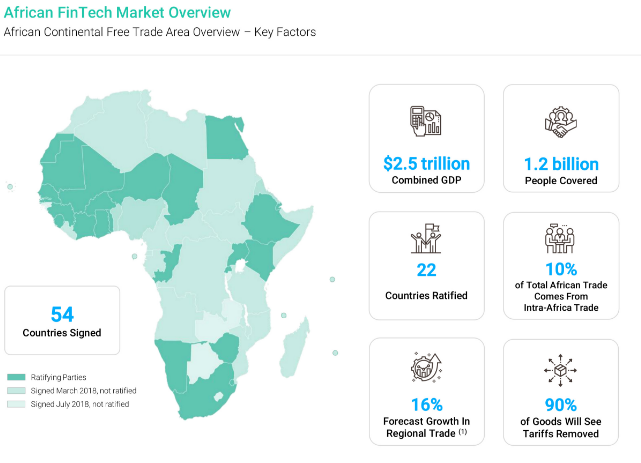

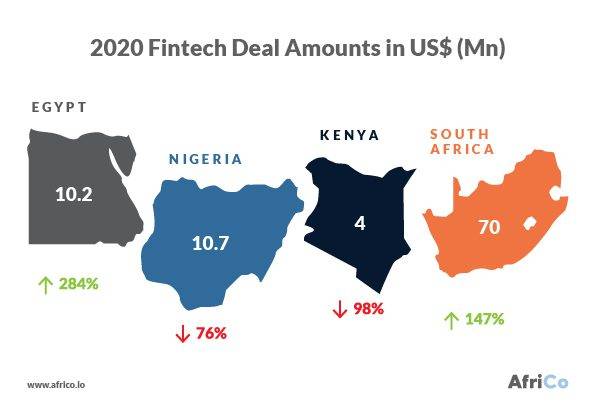

The growth of the African fintech sector is highly concentrated in a few countries. The four main fintech hubs are Egypt, Kenya, Nigeria and South Africa.

These 4 African countries made up ~85% of the total fintech investments in Africa in 2019 and received ~82% of the total investment in 2020. As these hubs get crowded with more and more fintech solutions as well as more and more capitalists, newer markets have to be explored by both entrepreneurs & early stage investors to target the next billion.

In 2020, countries such as Ghana, Uganda and Zambia gained prominence when it comes to number of investments in the fintech space as well as total startups upcoming every quarter.

M-PESA: Fintech as the social leveller

Smartphone payments are gaining ground in the US, but mobile money is old news in Kenya.The majority of the East African country’s population is subscribed to a mobile payment service, and the most popular choice is M-Pesa, which celebrates its 10th anniversary in March 2017.M-Pesa — “pesa” means “money” in Swahili — has made a dramatic impact over this time.The system was launched by Vodafone’s Safaricom mobile operator in 2007 as a simple method of texting small payments between users. Today there are 30 million users in 10 countries and a range of services including international transfers, loans, and health provision. The system processed around 6 billion transactions in 2016 at a peak rate of 529 per second.