India’s fintech revolution heralded a new age of banking for the country’s more than 63 million businesses and 190 million unbanked adults who had been on the fringes of financial services for most – if not all – of their lifetimes.

Read more at: https://yourstory.com/2020/12/fintech-sector-outlook-2021-india-startups

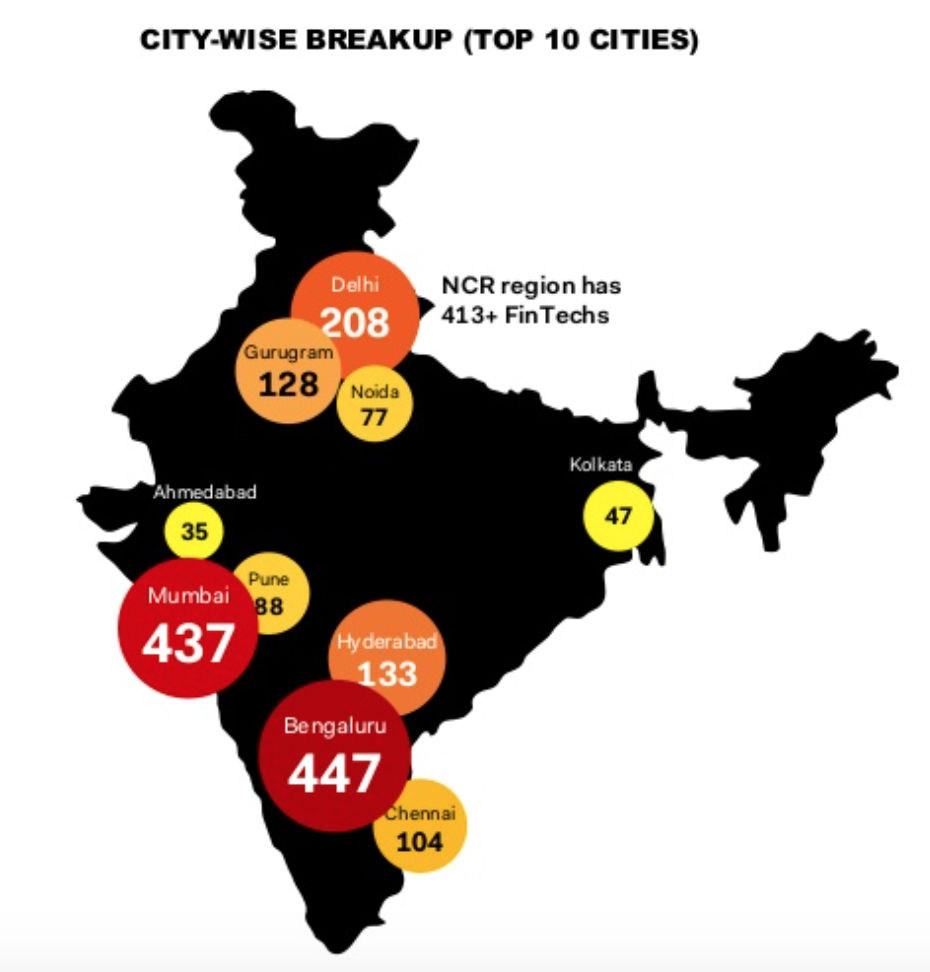

India’s fintech startup landscape counts 405 companies in payments, 365 in lending, 313 in wealthtech, 173 in personal finance management, 111 in insurtech, and 58 in regtech and cybersecurity, according to a research paper released in July by Medici. Most of these startups are located in Bengaluru (447) and Mumbai (437), which, between them two, represent 40.6% of all of the country’s fintech startups headquarters.

FinTech adoption in India has grown to 87% in 2019 as compared to 52% in 2017 as per EY Global FinTech Adoption Index 2019. Demographically, Males & females adopting FinTech applications stood at 88% & 84%, respectively, while age-wise people between 25 and 44 are highest adopters of FinTechs at around 94% while globally in the same age bracket FinTech adoption is seen at around 73%. The key drivers for the rise in FinTech adoption is due to Govt.’s thrust on leveraging initiatives and policy measures like Demonetization, Aadhar, UPI among a few. Money transfer and payments are the major drivers for fintech adoption at 94%, followed by Insurance at 76%, savings and investment at 67%, financial planning at 63% and borrowing around 61%. Globally, too money transfer and payments tops at 75% and borrowing bottoms out at 27%. People between the age group of 25 and 44 years are the most active adopters across all FinTech segments. While Govt. initiatives are one of the key drivers, the report also highlights access to innovative products and ease of onboarding are other key factors driving consumers to adopt different platforms. source: ET