Southeast Asia is one of the fastest-growing fintech markets in the world. The expected market growth is estimated to be between $70 billion and $100 billion by 2020, outpacing the likes of the U.S., U.K. and China. One of the contributing factors to this growth in this region is its insufficient financial inclusion. The World Bank data points to a lack of access to financial tools in southeast Asia. As per the data, in Indonesia, only 49% of adults have formal bank accounts; in Cambodia, the number is 22%, and in the Philippines and Vietnam, it’s 34% and 31%, respectively. The penetration of insurance and wealth management is also low. This makes it difficult for people to save, borrow, and manage money easily. This has given a tremendous opportunity to fintech companies to offer innovative opportunities for unbanked consumers to take fintech services and improve their financial situation. Investors are channelling funding into the region, with financial technologies as their primary investment. According to new data from CB Insights, fintech fundraising activity in southeast Asia grew by 143% year on year in 2018. Fintech investments in Southeast Asia increased by more than 30% through 2018 to reach approximately $6 billion. content via: finovate.com

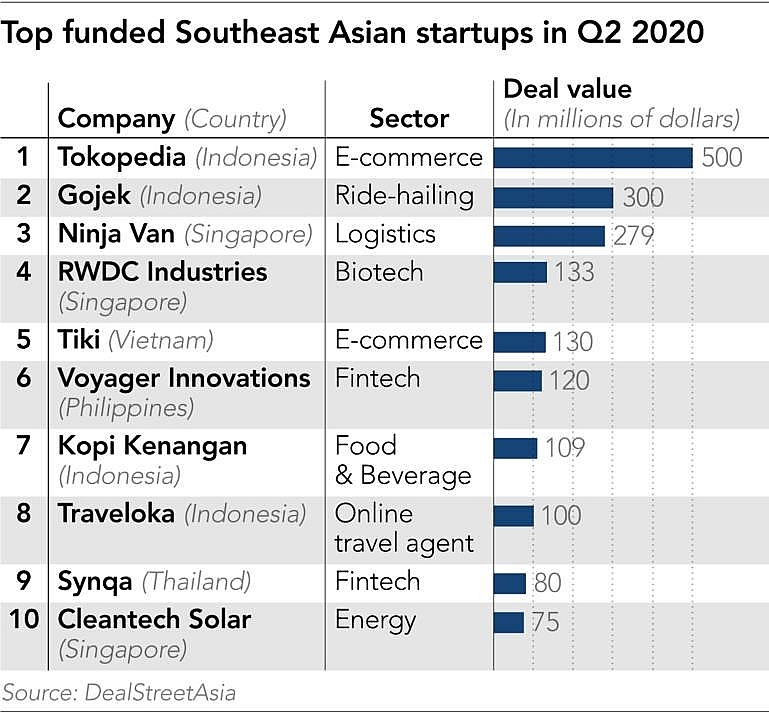

Data from newswire DealStreetAsia also revealed that since the mid-2010s, Southeast Asia’s startup funding boom has been led by Singapore’s Grab and Indonesia’s Gojek – the two prominent “unicorns” focusing on ride-hailing and food-ordering services.